Afentra plc is a London listed upstream oil and gas company, focused on acquiring production and near field development assets, with its core portfolio located in Angola. The Company is implementing a strategy that delivers enhanced value for stakeholders and long-term sustainable growth.

Operational Highlights

2024 Net Average Production

Net 2P+2C Reserves and Resources

Financial Highlights

2024 Revenue

Cash Resources at 31 December 2024

Delivering value in

the energy transition

Afentra’s aim is to build a material diverse portfolio of production, near-field development and exploration assets with significant upside potential, with a focus on shareholder returns and delivering value for all stakeholders as the company supports a just African energy transition.

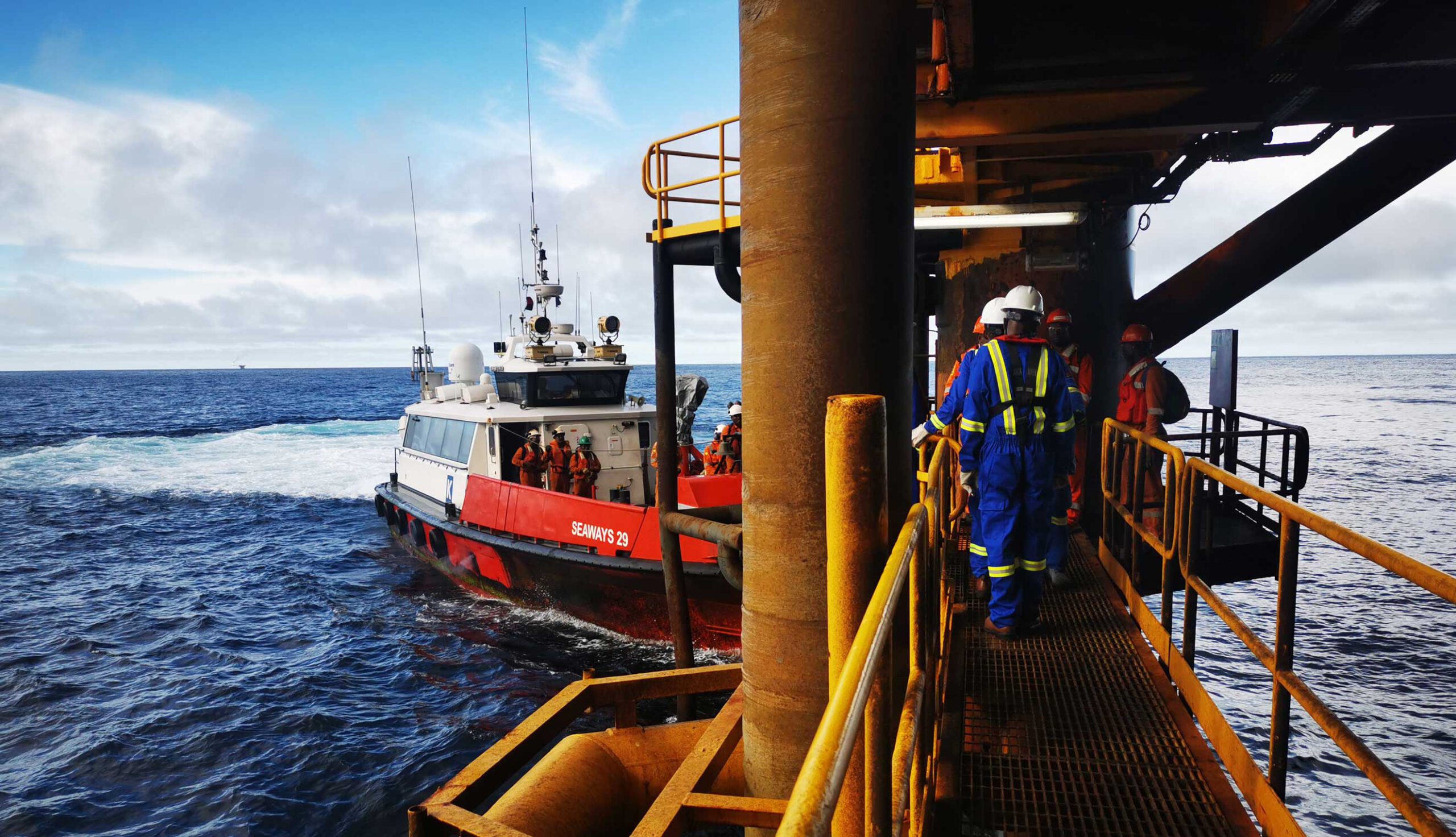

World-class assets with significant upside potential

Afentra’s core portfolio of assets are located offshore and onshore Angola, providing exposure to world-class midlife assets, near-field development assets and short-cycle exploration opportunities with significant upside. Angola holds significant opportunities to access abundant untapped resources that are primed for optimisation following a prolonged period of underinvestment.

Prioritising the needs of all stakeholders

Afentra is committed to positive socio-economic and environmental outcomes, with responsible stewardship and investment in assets. Hydrocarbons are part of the energy transition and will continue to remain important in the overall energy mix, so a just transition must balance social economic impacts alongside environmental impacts.