Latest news and upcoming events

The need for a responsible energy transition

How this transition can impact African social-economic development

Drivers of change

Changing responsibly

Impactful change

Climate change

The global energy transition is being driven by political, corporate and civil society in pursuit of the goals set by the international community to decarbonise globally. The energy industry is seeing Oil & Gas majors recalibrate their strategies and business models to a lower carbon energy system.

Growing demand

With a rising demand for the services that energy provides due to a growing population – many in Africa (600-800 million people) who remain without access to modern cheap reliable energy – the developing world must be able to responsibly create long-term social and economic value by efficiently optimising the potential of their natural resources.

Oil & Gas Transition

The Africa Oil & Gas industry is in the early stages of the same operator transition that the North Sea and the Gulf of Mexico have gone through with assets being transferred from majors to independents. IOCs are looking to responsibly exit out of assets which are either late life, not material or have a high carbon footprint.

Developing Economies

Whilst the developed world is seeking to deploy capital in a manner that actively supports the energy transition and lower carbon economies, developing economies currently lack the large scale capital required to support the industrial roll out of renewable technologies and remain largely reliant on traditional energy sources.

Global energy mix

There is a growing recognition that oil and natural gas play critical roles in today’s energy and economic systems; and that affordable, reliable supplies of liquids and gas are integral to the transition to a lower carbon world.

Maintaining supply

Without a responsible Oil & Gas industry, the transformation of the energy sector will be more difficult and more expensive. If capital markets are engaged correctly, independents can help to accelerate the pace of change and reduce the impact on the environment.

Emissions reduction

There are cost-effective opportunities to bring down the emissions intensity of delivered Oil & Gas by minimising flaring of associated gas and venting of CO2, tackling methane emissions, and integrating renewables and low-carbon energy where-ever possible.

Responsible investment

The best way to protect the climate is for investors to invest in responsible Oil & Gas companies with the imperative to reduce energy-related emissions in line with international climate targets.

GDP contribution

The economic contribution from natural resources is fundamental to many developing economies. It is therefore essential that investments in these resources continue as these developing economies navigate their journey through the energy transition.

Responsible Independents

There is a requirement in the market for responsible, well managed independents to acquire, operate and optimise post-peak assets in Africa. This will ensure the continued socio-economic benefit from these resources as the majors exit.

Building on capability

Independents can leverage the local resources and skills of the industry and ensure that they play a central role in responsibly managing these assets. The continuing transfer of knowledge can play an important role in the reduction of the emissions intensity of delivered Oil & Gas.

Attracting Capital

Accessing the necessary capital to invest in the continued development of these assets responsibly will only be possible by addressing investors ESG concerns. It is necessary for responsible independents to integrate an ESG agenda into their business model and operating approach in order to effectively manage business and opportunity risk.

Our Portfolio

Our strategy is to build a material diverse portfolio of mid-life producing assets that provide scope to optimise production and reduce emissions.

Overview

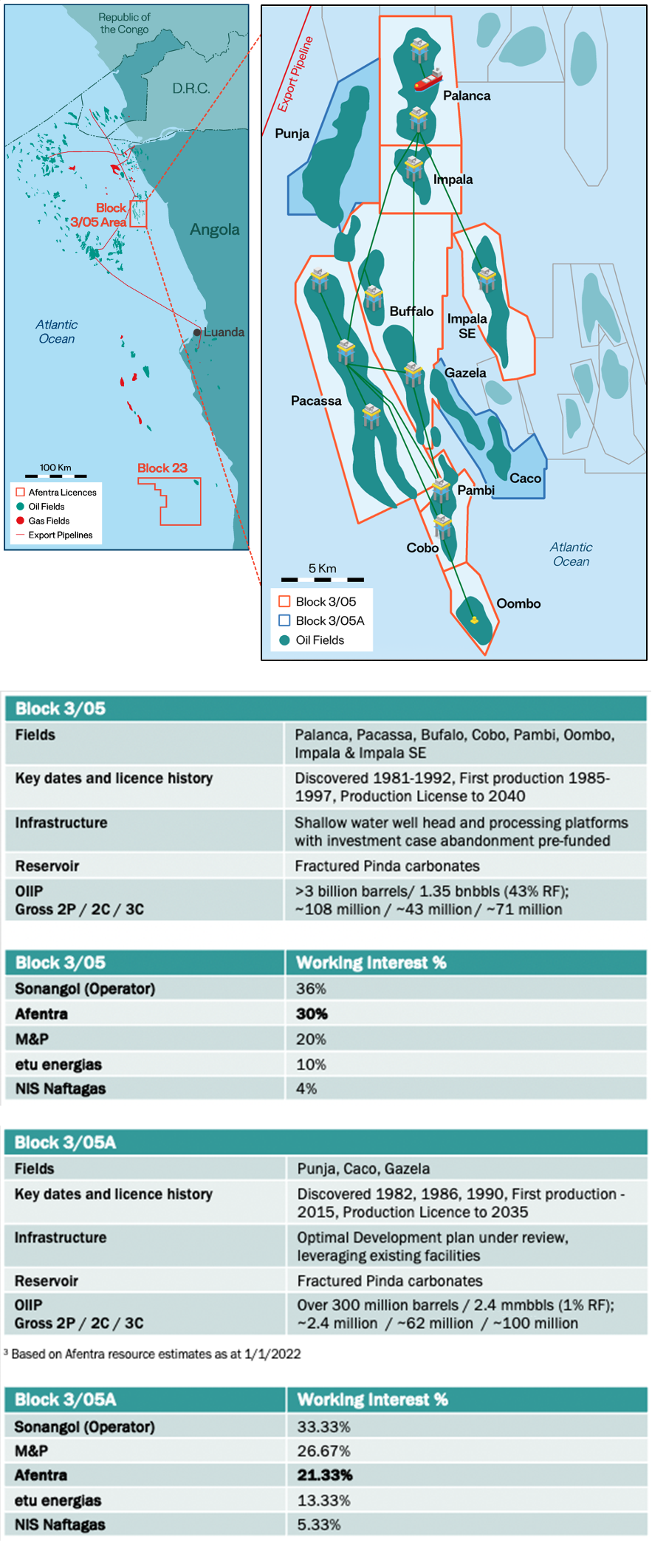

Angola: Blocks 3/05, 3/05A, 23 and KON 19

Somaliland: Odewayne Block

Afentra’s portfolio is comprised of an 30% non-operated interest in the long-life, offshore production Block 3/05 in Angola, and a 21.33% interest in the adjacent Block 3/05A offering additional development potential. In addition, Afentra has a 40% non-operated interest in the highly prospective Block 23 in Angola. Onshore Angola, Afentra has a 45% non-operated interest in the exploration Block KON 19 located in the western part of the Onshore Kwanza Basin. Afentra also holds a 34% non-operated (carried) interest in the Odewayne Block, onshore Somaliland.

Afentra’s strategy is to build a material diverse portfolio of mid-life producing assets that no longer fit the portfolio of major companies. We seek to optimise, redevelop and extend their lives in a safe, responsible manner whilst reducing harmful emissions. These production assets underpin the business with low-risk cash flow. Over time, Afentra aims to build a portfolio of operated positions, levering the extensive technical operating experience possessed by the team. We will also acquire non-operated positions alongside quality operators and credible JV partners with a shared alignment to operational excellence and environmental stewardship.

Afentra’s entry into Angola in May 2023 saw the Company establish a foothold in a key target geography with a wealth of future growth opportunities. Afentra is acquiring interests in quality assets with scope to enhance and extend production alongside improving environmental performance, while positioning itself as a key stakeholder to support state-owned Sonangol with its transition strategy.

High quality, long-life, shallow water production asset with material upside potential

Afentra initially acquired a 4% non-operated interest in Block 3/05 through its transaction with INA that completed in May 2023. The transaction with INA included a 5.33% interest in the adjacent Block 3/05A offering additional development potential. Following the completion of both the amended Sonangol transaction and the Azule transaction, Afentra’s interest in Block 3/05 and 3/05A has increased to 30% and 21.33% respectively.

Afentra also holds a 40% interest in the exploration and appraisal Block 23, located in the Kwanza basin.

Onshore Angola, Afentra has a 45% non-operated interest in the exploration Block KON 19 located in the western part of the Onshore Kwanza Basin.

Block 3/05:

Block 3/05, operated by Sonangol, is a material shallow water production asset with the potential to deliver significant upside value. The long-life asset benefits from existing infrastructure across the portfolio of 8 fields and holds in excess of 3 billion barrels of light oil in place. As of end 2022 c. 1.35 billion barrels has been produced (~42% recovery factor). Afentra’s 30%* interest in Block 3/05 provides certified 2P reserves of 32.9 mmbbls and 2C resources of 13.1 mmbbls net to Afentra (CPR estimates as of 1 January 2023) and net production in excess of 6,500 bbl/d on a gross average production of 20,180 bbl/d for the year 2023.

Importantly, in the next few years, sustaining current production levels relies on re-instating and sustaining the waterfloods in tandem with integrity, maintenance and existing well stock optimisation projects. These activities are all low cost, rapid capital return activities.

Afentra sees significant additional value creation potential in Block 3/05 with a portfolio of projects identified to potentially increase production. This will consist of, but not be limited to, the following:

Integrating near term asset integrity revitalisation and infrastructure upgrades.

Production optimisation and debottlenecking opportunities.

Optimisation of the existing well stock including workovers, access to behind pipe oil pools and optimisation of artificial lift applications.

Longer cycle brownfield development opportunities such as in-fill drilling and the tie-in of undeveloped discoveries.

Further upside not included in ERCE’s resource case have been identified and are under review, including additional infill drilling at the Bufalo, Pacassa and Oombo Fields, alongside potential access to shallower reservoirs.

The asset maintains a strong safety track record and the JV is working to improve ESG characteristics, including decreasing emissions in line with zero flaring by 2030 and gas utilisation opportunities.

Block 3/05A:

Block 3/05A, operated by Sonangol, contains 3 appraised light oil discoveries with a combined STOIIP in excess of 300 mmbbls from which only 2.4 mmbbls has been recovered to date (c. 1% recovery factor). The existing Block 3/05 infrastructure and synergies with the application of fit for purpose technology provides the opportunity for production growth potential via tie backs. Our multi-disciplined team is taking a holistic view of Block 3/05A and Block 3/05 together, working with the operator and contractor group to progress these opportunities towards value generating appraisal and development.

Afentra sees significant further value in the Block 3/05A asset in tandem with the Block 3/05 asset that it surrounds, consisting of but not limited to the following:

An integrated gas management plan across both Blocks 3/05A and 3/05 to develop these resources responsibly given the high gas oil ratio of the Punja field reservoirs.

Long term testing of the Gazela field is underway providing valuable data to inform the next steps for the Caco-Gazela Field development.

Progression of Punja and Caco-Gazela will be carried out in a phased approach to gain appraisal data, reduce uncertainty and generate cash flow through monetising early production.

Screening and ranking multiple development concepts to reach an optimised FID.

Block 23 (working interest 40%):

Block 23 is a 5,000 km2 exploration and appraisal block located in the Kwanza basin in water depths from 600 to 1,600 meters and has a working petroleum system. Whilst the large block is covered by modern 3D and 2D seismic data sets, with no outstanding work commitments remaining, much of the block remains under-explored. The block contains the Azul oil discovery, the first deepwater pre-salt discovery in the Kwanza basin. This discovery made in carbonate reservoirs has oil in place of approx. 150 mmbbls and tested at flow rates of approx. 3,000 – 4,000 bbl/d of light oil.

The block contains the Azul oil discovery, the first deepwater pre-salt discovery in the Kwanza basin. This discovery made in carbonate reservoirs has oil in place of approx. 150 mmbbls and tested at flow rates of approx. 3,000 – 4,000 bbl/d of light oil.

Block KON 19:

Afentra has a 45% non-operated interest in the exploration Block KON 19 located in the western part of the Onshore Kwanza Basin.

The Onshore Kwanza Basin, covering 25,000 Sqkm is an under-exploited, over-looked proven hydrocarbon basin and has numerous oil fields and discoveries dating back to 1955. The basin produced over 15,000 bopd in the 1960’s and 1970’s from post-salt traps.

KON 19 was high graded by Afentra as it has good signs of a working petroleum system and contains wells that were drilled on salt structures with light oil recovered to surface in one and oil shows in others from post and pre-salt reservoirs. There is limited 2D Seismic data. The block is adjacent to both legacy oil fields that are currently being appraised for potential re-development and existing infrastructure allowing rapid commercialisation.

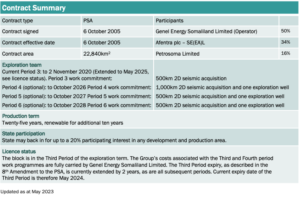

Fully carried interest in under-explored frontier acreage

(34% non-operated carried interest)

Somaliland offers one of the last opportunities to target an undrilled onshore rift basin in Africa. The Odewayne block, with access to the Berbera deepwater port less than a 100km to the north, is ideally located to commercialise any discovered hydrocarbons. This large, under-explored, frontier acreage position covers 22,840 km2, the equivalent of c. 100 UK North Sea blocks.

Afentra inherited its carried interest in Odewayne from its previous form as Sterling Energy, and through its wholly owned subsidiary (Afentra East Africa Limited), holds a 34% working interest in the PSA. Afentra is fully carried by Genel Energy Somaliland Limited for its share of the costs of all exploration activities during the third and fourth periods of the PSA.

Recent activity on the Block includes the re-interpretation of seismic data and seep analysis in order to develop an appropriate forward work program to further evaluate the licence prospectivity.

Effecting sustainable change

Delivering value in the energy transition

Matching our business to the varied needs of our stakeholders

Our mission

Our integrated model

Our stakeholders

Africa’s strong economic growth alongside its growing population underpins our belief in the continent’s long-term Oil & Gas demand despite the structural evolution of the global energy system. We see a significant opportunity to drive responsible growth and prosperity for all stakeholders. Our strategy is simple, we only focus on proven hydrocarbon basins where fields have been discovered or are currently producing. The latent potential is therefore clear and Afentra just needs to unleash it, quickly and economically. We pursue operatorship with a large working interest so we have control over the safety, development and investment profile of our assets.

Afentra was created to take advantage of this opportunity in the African market, emulating the successful precedents set in the Gulf of Mexico and North Sea.

See our four-stage model to discover how we implement our strategy.

Defining legacy assets

- May no longer fit with a company’s strategy in Africa

- May need investment, regeneration or upgrading

- May be sub-economic for larger companies

Stakeholder returns

Our business model is designed to mitigate geological, political and financial risks to enable Afentra to deliver sustainable returns to its shareholders in the form of capital appreciation and dividends when appropriate. We do this by focusing on discovered resources in established operating jurisdictions, alongside credible partners, and by maintaining a stable balance sheet, underpinned by low-risk cash flow.

Assess & acquire

Our focus

- Opportunities that:

- Are value accretive

- Generate robust cash flow

- Have embedded growth opportunities

- Are strategically complementary

Optimise & produce

Our focus

- Emissions reduction

- Optimisation of subsurface facilities

- Returns enhancement

- Performance transparency

Reinvest & extend

Our focus

- Infield, outpost and undeveloped resource investment opportunities

- Funding further value accretive acquisitions

- Workforce and community development

- Acceleration of the de-carbonisation initiatives

Retire & convert

Our focus

- Responsible stewardship

- Restoration of the natural environment

- Safe decommissioning

Our cultural framework

Afentra’s cultural framework outlines our core principles, philosophies and values that guide our behaviours and enables us to drive our business forward and deliver on our purpose.

Our framework provides a strong foundation that supports our vision, guides our behaviours and influences the impact we make on the world around us.

Principles

Be Respectful

Be Transparent

Be Inclusive

Be Authentic

Values

Inspire

Collaborate

Enquire

Innovate

Approach

Think Long-term

Create Solutions

Leverage Learning

Focused and Nimble

Impact

One team

Positive difference

Enduring value

Experienced leadership

Afentra has established a strong executive team with a proven track record for creating value and positive stakeholder outcomes through delivery of material development and production projects across Africa. The team has an established network across the relevant stakeholder audiences, and direct experience of the energy transition in previous geographies. The Board bring significant industry and capital market experience as well as an unwavering commitment to all aspects of Governance. Their experience and expertise will ensure the responsible pursuit of strategic priorities intended to create value for all stakeholders.

Executive team

Non-Executive team

Chief Executive Officer

Paul McDade

His strong focus on delivering stakeholder value, shared prosperity, environmental performance and strong governance, coupled with his understanding of the role that Oil & Gas has to play in both the global and African energy transitions, makes him the ideal leader to deliver Afentra’s ambitious growth strategy, a company that will have stakeholder objectives and ESG embedded at its core.

Chief Operating Officer

Ian Cloke

He has first-hand experience in making a difference in countries having discovered and successfully delivered commercial Oil & Gas in Uganda, Kenya and Guyana amongst others. Having lived and travelled throughout Africa, he has enjoyed the full spectrum of life and business on the continent, making him an ideal founding partner and COO of Afentra.

Chief Financial Officer

Anastasia Deulina

Her primary focus is always on driving sustainable business growth that has a visible positive impact on the bottom-line. This, along with her significant prior board experience, both as a NED and committee member, and her strong global business development and financial network means that Anastasia provides expert leadership as Afentra’s CFO.

Independent Non-Executive Director

Thierry Tanoh

Independent Non-Executive Chairman

Jeffrey MacDonald

Independent Non-Executive Director

Gavin Wilson

Latest information

Investment case

- Building a diverse portfolio of assets underpinned by robust economics and proven resources

- Energy transition creating compelling M&A pipeline of producing assets and proven resources

- Gap in market for credible operators to facilitate a responsible energy transition

- Angola represents stable operating environment with supportive government and attractive fiscal terms

- Asset base provides scope for production optimisation and reduction of emissions profile

- Proven team with significant experience and industry track record in Africa

- Initial deals demonstrate value enhancing nature of commercial strategy

News and media

Afentra drills down into details on major Angola assets

Investor Webinar Presentation

An equitable and just energy transition should balance sustainability with social cost

This article first appeared in PE Outlook 2024

Afentra acquired assets worth 255m with only 37m cash heres how

Africa-focused Afentra poised for multimillion dollar returns from shallow water oil exploration

Readmission to AIM

Africa-focused junior eyes access to untapped discoveries

Afentra CEO eyes ‘conveyor belt of deals’ as majors retreat from mature African basins

Azule Acquisition and Sonangol Acquisition Update

Annual General Meeting 2023

INA Completion & Angola Update

SpareBank 1 Markets Energy Conference

ANPG confirms Afentra acquisitions in Angola

Angolan Acquisitions & Resumption of Trading

Annual General Meeting 2022

The Changing Face of Energy

Sonangol SPA

Namibia’s new era of hydrocarbon exploration and production

A just energy transition for Africa

Energy 2050 Africa Series Roundtable

credit: Frontier and the Africa E&P Summit

Afentra set to seize upon ‘African energy transition’

About